The 2025 Homeowner’s Guide to Maximizing Solar Savings Before Incentives Expire⚡

Federal solar tax credits have helped thousands of Florida homeowners save big on installation and energy costs—but these benefits won’t last forever. By the end of 2025, the 30% Federal Investment Tax Credit (ITC) begins to phase out, making 2024–2025 your final window to lock in maximum returns.

This guide breaks down:

- 📉 How solar shields you from rising energy prices

- 🧾 What the federal tax credit covers (and when it ends)

- 🛠️ What you need to do now to qualify

- 💰 How much Florida homeowners are saving today

- 🚀 Next steps to take before the deadline

🌤️ Section 1: Why Solar is the Smartest Financial Move in 2025

- Protect Your Budget: Utility rates in Florida have risen over 15% in the past five years—and projections show no sign of slowing. Solar allows you to lock in predictable energy costs for decades.

- Immediate Payback: Most systems start generating returns on day one. With tax credits and financing, you can go solar with zero upfront cost in many cases.

- Increase Your Home Value: According to Zillow, homes with solar sell for 4.1% more on average.

💵 Section 2: What You’ll Lose If You Wait

The Federal Solar Investment Tax Credit (ITC):

- ✅ 30% off total system cost through the end of 2025

- 🕒 Drops to 26% in 2026, then 22% in 2027

- ❌ Disappears completely for residential systems in 2030

Example: If your system costs $28,000:

- With 30% ITC (2025) = $8,400 back in your pocket

- With 26% ITC (2026) = $7,280 back

- Missed window = $0

🔍 Section 3: What a Customized Solar Plan Looks Like

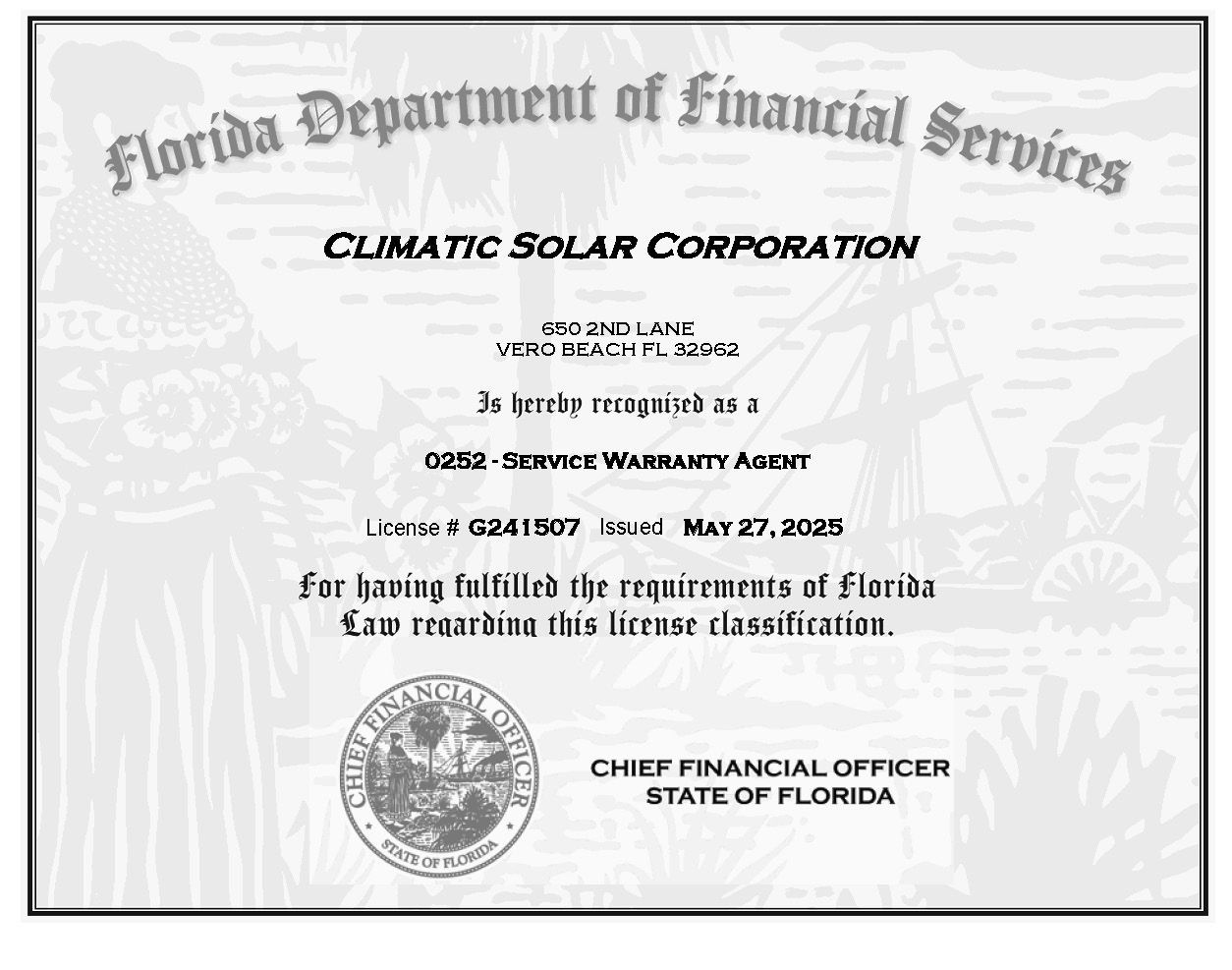

Every home is different, but a typical Climatic Solar plan includes:

- Design based on your usage + roof layout

- Full permitting & utility approval

- Performance estimates & guaranteed savings

- Flexible financing options

“Climatic made the process so easy. Our bill dropped from $220 to $40, and we’re protected from future hikes.” — The Gonzales Family, Port St. Lucie

📆 Section 4: How to Act Before the Deadline

- ✅ Step 1: Schedule a free consultation

- ✅ Step 2: Get your custom system design and savings estimate

- ✅ Step 3: Lock in federal tax credit and secure your install spot before schedules fill up

📌 Important: Many installers book up quickly before tax credit changes. The earlier you start, the better your install timeline and savings.

🚀 Ready to Maximize Your Solar Investment?

Don’t leave money on the table. Whether you're looking to expand your system or help a friend go solar, the time to act is now.